Write off all of your income.

Find out how under the 2020 CARES Act.

Find out how under the 2020 CARES Act.

The COVID-19 pandemic has brought unprecedented challenges in the fight to help those experiencing homelessness. In the midst of the crisis, our government has just passed a law that creates new ways to give generously to public charities. It’s called the CARES Act. And for those of us who, as Christ followers, have a passion for using our resources to help others, this is the opportunity of a lifetime.

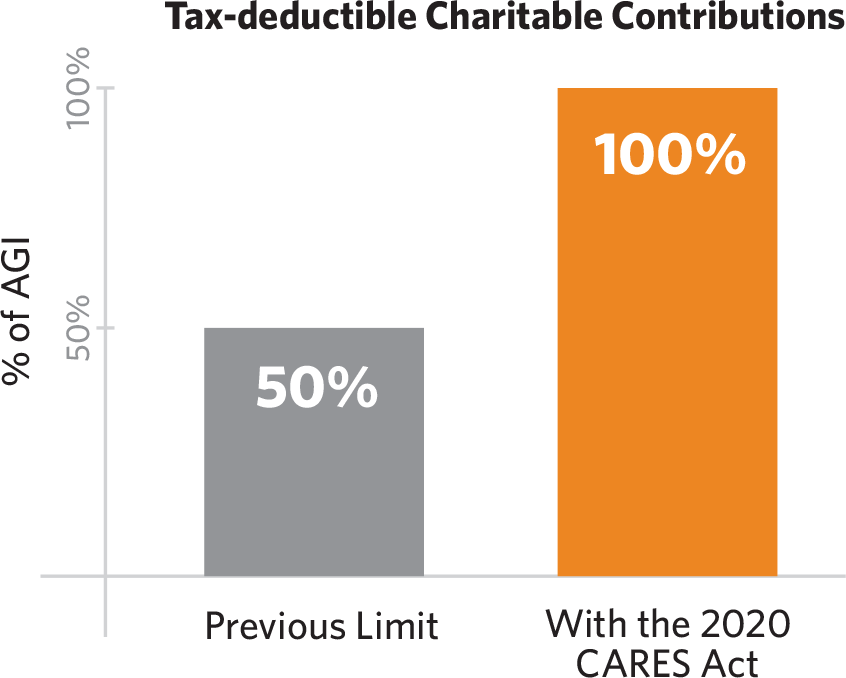

Under the CARES Act, you can take a charitable deduction against 100% of your 2020 income for federal tax purposes by making the donation in cash, to a regular public charity such as Union Rescue Mission, before the end of the year.

Such “qualified donations” are deductible up to the full amount of your total income (Adjusted Gross Income or “AGI”), reduced only by any charitable deductions you are already taking.

Anyone can still give stocks, real estate, or business interests they’ve held for more than one year to a public charity, get a fair market value deduction against 30% of their AGI, and not pay taxes on the capital gains.

Those over age 701/2 can make up to $100,000 in Qualified Charitable Distributions from an IRA account and not have that distribution count as income.

The 100% income tax deduction for cash gifts allows us to use assets for giving that we normally can’t reach. We can withdraw retirement assets, exercise employee stock options, and even get rid of environmentally “challenged” real estate.

Read below to understand some of these unique giving strategies under the CARES Act.

Get the most out of this year’s opportunities.

Some assets are typically poor candidates for charitable giving. The deduction for donating stocks, bonds and real estate held for less than one year is limited to your basis (cost) as are gifts of inventory, intellectual property, and most gifts of art. Real estate with environmental problems often can’t be gifted at all as the charities can’t handle the risks. Even real estate with normal debt is a problem as the gift is limited to the equity in the property, the debt relief produces a taxable gain, and the charity has to be concerned with debt service. In all those situations, the potentially simple solution is to sell the property and donate the proceeds. Because this year you can donate 100% of your gains, your cash gift will all be deductible!

Under the regular rules, anyone over 701/2 can donate up to $100,000 per year directly to charity from an IRA account and those funds are not taxed as a withdrawal. They also count toward any Required Minimum Distribution. But any other withdrawal from IRAs, 401(k) plans, pension, or profit-sharing plans is almost always taxable income. But for this year, anyone who can withdraw assets from any qualified plan without a penalty, typically anyone over age 591/2, can take those IRA, 401(k) or pension plan funds and donate them to charity. The withdrawal still increases your income, but since the donation is fully deductible, your donation offsets the increased income and you effectively achieve a federal tax-free withdrawal of such proceeds!

Many employees at publicly traded companies have significant compensation in the form of non-qualified stock options or Restricted Share Units. Under the tax laws, these contract rights are usually not assets that can be donated before being exercised. The holder’s only option is to exercise at which point the “gain,” the amount in excess of any required payments, is taxable as ordinary income or capital gains. In the 2020 tax year, since 100% of any charitable donations are deductible for federal income tax purposes, here too you can exercise as many options as you want and donate all the gains to charity.

Contact Rosie Perez at rperez@urm.org or call (213) 673-4593

Legal Disclosure This page is solely for educational purposes and is published with the understanding that in sharing this information, the authors are not engaged in rendering legal, accounting, or other professional services. Charitable giving is, typically, only one part of an individual or family’s financial world. Consequently, if you are considering a major charitable gift, it is extremely important that you first obtain professional legal, accounting, and financial advice from your own independent advisors.